How Much Money To Buy An Apartment Complex

Apartment Complex Financing.

How much money to buy an apartment complex. A lower ltv usually gets a lower rate. Its no good to buy what you think is a cashflowing asset and then find out that it sucks money out of your pocket. Here are six ways to invest in apartment buildings.

Financing an apartment complex is different from financing a single-family home. These include property expenses as well as any losses in addition to other unexpected. And approval will be based more on whether financial projections show the property can support the loan payments than on your credit history.

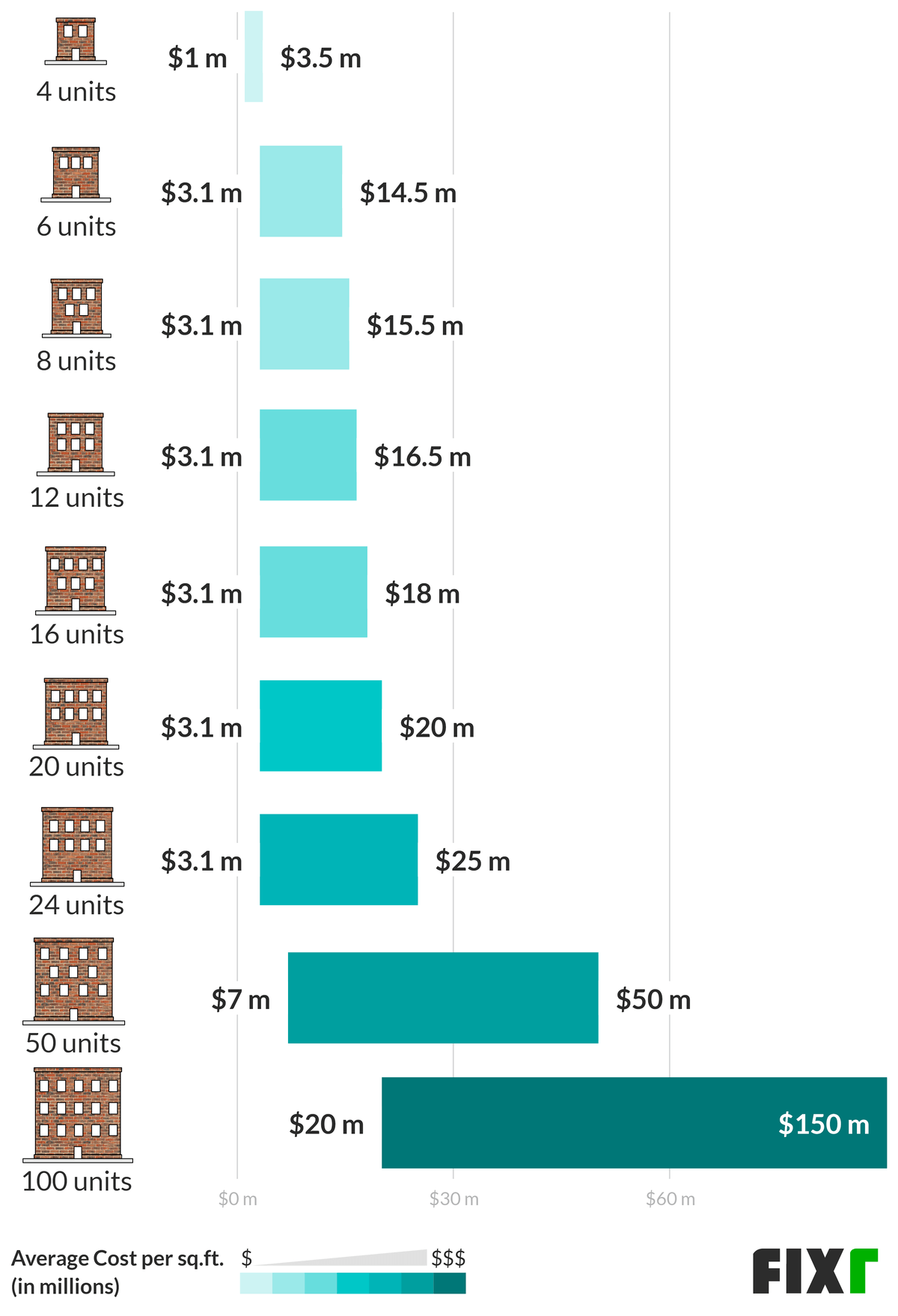

The cost of owning the complex should be between about 20 and 50 of the money brought in by the complex. For example on our third deal we purchased a 136 unit apartment complex for 4075000. Also shoot for bigger assets so that you get non-recourse loans.

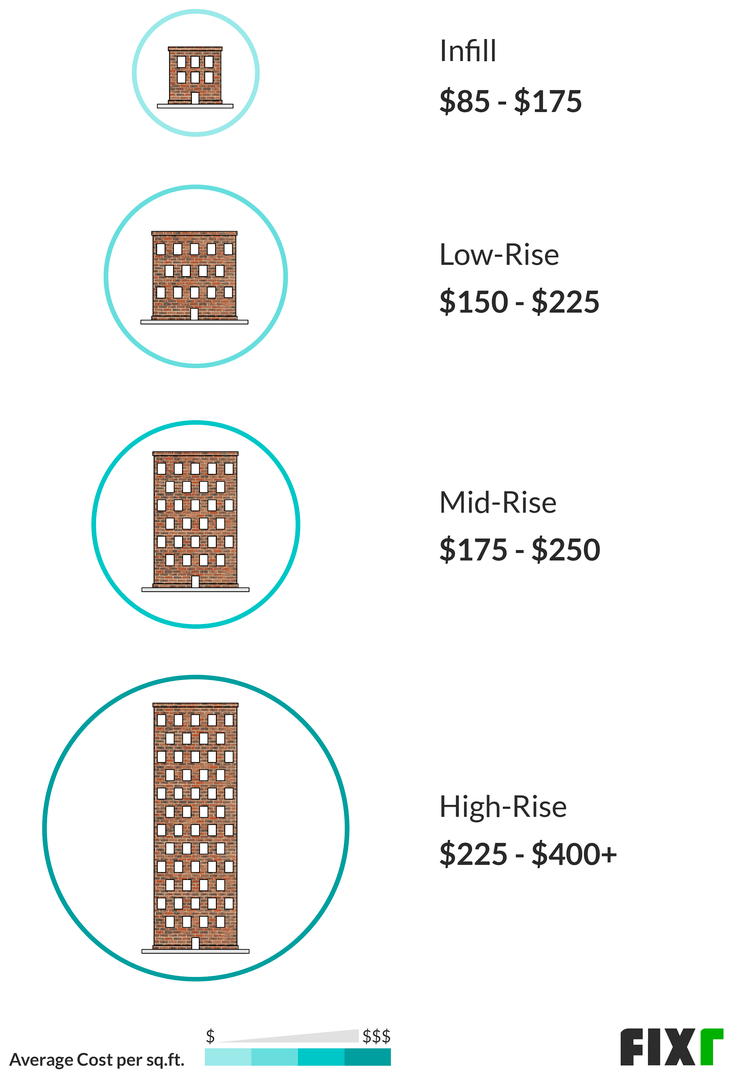

If you improve the reputation of an apartment complex your vacancy rate should decrease accordingly. The above figures place this construction at an 85 and 200 per. All these factors increase the propertys value boosting your capital gains when you sell.

Because there is a guaranteed income from multiple sources. Leverage - If you borrow a million dollars from the bank 4 and use it to buy an apartment complex with an 8 cap rate return on investment - you can profit off the difference. By reaching the point where we are comfortable bringing in equity investors we are now actively looking for apartment complexes in both the Cincinnati and Atlanta markets up to a 10 million dollar purchase price.

Its amazing what happens to utility bills when tenants share in the responsibility. Single-family vs Multi-family Investment When building or purchasing an apartment or rental property as an investment consider the investment costs of a single-family versus a multi-family residence. A twelve unit apartment complex.

/multi-family-housing-construction-1163226282-0bc5b7ac983d4a3ea47070dacf640eb6.jpg)

:max_bytes(150000):strip_icc()/GettyImages-942487282-ae2da73b74aa4e868af3a6beac662e52.jpg)